#How to organize your bills and budget free#

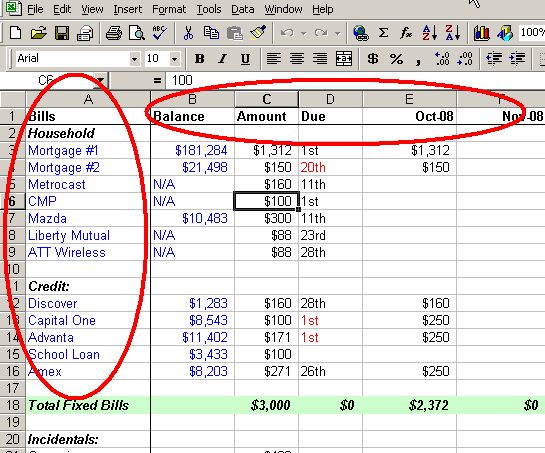

I’m always putting out new printables so make sure you subscribe on the form below so you don’t miss them! Check out these 2021 free printables. To effectively manage your money, you must have a budget. Keep your old bills, but you don’t have to leave the hanging around your kitchen collecting clutter. This bill payment organizer has saved me countless times! For instance, when the power goes out, I don’t have to dig and find our last electricity bill because I can just look at this set of printables to find the right phone number to call. This way, if you need to call to inquire about a bill you have the info readily available and don’t have to dig around for your account number and their phone number in your filing cabinet. This Household Bill Organizer is a summary of all your bills including account info, phone number and more. I like having all the key info about my bills in one spot. Start by making a list of your monthly income sources, including your salary (after taxes), any bonuses you incur on a regular basis, and child support or alimony payments. Most people budget monthly because most bills follow a monthly schedule. Stay on top of things and always know what is ahead. To do this, you need to evaluate your income and your expenses. Companies will still want their money so using the fact the bill never arrived isn’t an excuse. I have been creating a budget by paycheck since I got my first job at 16 yrs old. Once you have all of the bills together, I want you to list them out on one sheet so.

#How to organize your bills and budget how to#

It will also keep you aware if somehow you don’t get a bill in the mail (or email). How to Organize Monthly Bills Write Out Your Bill Information. The first way is by lumping all categories into a single master category. This organizer is great for those regular bills we all get like our power, phone, cable and heating. Throughout my budgeting journey, I have realized there are two ways to organize your budget using categories. After you pay them, cross them off with an x. At one glance you can see all the payments that are coming due. You can list out your monthly bills for the year and put in the amounts in the appropriate column. The first printable is a Bill Payment Organizer. Your credit rating will thank you for it. Write it down and ensure you don’t ever miss an important payment. Sure, you can keep it all in your head, but the chances of you forgetting something is high. Once you have a budget, write down all your liabilities, payment, and monthly expenses. Budgeting helps you to organize your finance and know when to spend and when not to spend. Without having a budget, your finances will be in jeopardy. If you’re using a budget to keep track of your finances learning how to organize your bills can help you build a better a budget. If you’re in debt you might have learned about the snowball method where you should be paying your smaller debts off first. When it comes to paying your bills the process seems simple, pay before or on the due date and then wait until the following month. Today, I have a couple free bill organizing printables to help you get your t’s crossed and i’s dotted, so to speak! Having a system in place will save your sanity. Budgeting is a critical step in organizing your finances and making the best out of them. Organize Your Bills to Build a Better Budget. One of the first things I did was write everything down in one spot. By subscribing, I consent to receiving emails.

0 kommentar(er)

0 kommentar(er)